nh bonus tax calculator

The current combined Social Security and Medicare tax rate is 765 percent. And remember to pay your state unemployment.

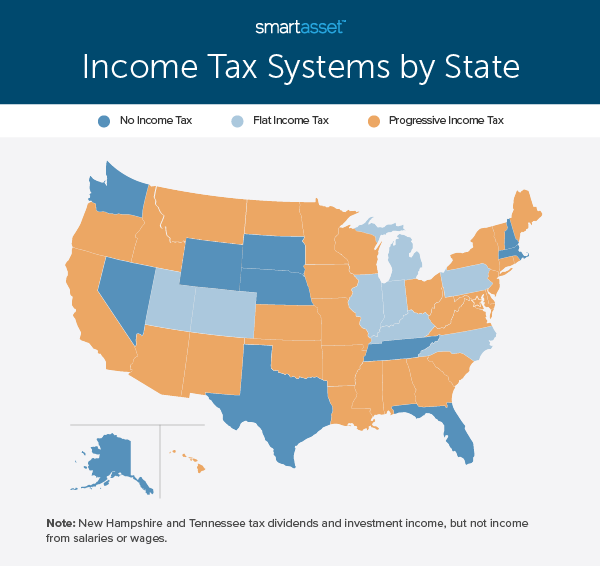

State Income Tax Rates Highest Lowest 2021 Changes

New Hampshires excise tax on cigarettes totals 178 per pack of 20.

. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A cash bonus is treated similarly to wages and is taxed as such. Use tab to go to the next focusable element.

Receive Blog updates via email. Military bonuses are subject to taxation at the time of payment. That means that your net pay will be 42787 per year or 3566 per month.

If you make 55000 a year living in the region of New York USA you will be taxed 12213. Another option is to put more of your paycheck into an HSA or FSA if your employer offers it. Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method.

New Hampshire Bonus Tax Percent Calculator Results. State of New Hampshire. New Hampshire has a 0 statewide sales tax rate and does not allow local.

NHgov privacy policy accessibility policy. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. You will report the bonus as wages on line 1 of Tax Form 1040. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Your average tax rate is 222 and your marginal tax rate is 361.

Signing bonus taxes would fall in the above category if received via cash gift. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. If your total bonuses are higher than 1 million the first 1 million gets taxed at 22 and every dollar over that gets taxed at 37.

For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. Supports hourly salary income and multiple pay frequencies. Recently accepted a new job.

The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. If your state doesnt have a special supplemental rate see our aggregate bonus calculator. If youre from New Hampshire you probably love the Granite State for its lakes mountains coastline and most importantly lack of taxes.

This free easy to use payroll calculator will calculate your take home pay. In this state we shop and work tax-free. FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent.

The results are broken up into three sections. The 2022 state personal income tax brackets are. Below are your New Hampshire salary paycheck results.

The current Social Security tax rate is 62 percent for employees. Before the official 2022 New Hampshire income tax rates are released provisional 2022 tax rates are based on New Hampshires 2021 income tax brackets. Our free online New Hampshire sales tax calculator calculates exact sales tax by state county city or ZIP code.

TAX DAY NOW MAY 17th - There are -385 days left until taxes are. Your employer must use the percentage method if the bonus is. Or use the expertise of a tax pro to help you do so Signing Bonus Tax.

And while New Hampshire doesnt collect income taxes you can still save on federal taxes. Wage. You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code.

However if youve moved TO or FROM New Hampshire lately you know there is one type of tax you cannot avoid here. Start filing your tax return now. New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

In the case of a non-combat zone military bonus pay or others subject. Calculates Federal FICA Medicare and withholding taxes for all 50 states. New employers should use 27.

You will report the bonus as wages on line 1 of Tax Form 1040. In NH transfer tax is split in half by buyer and seller. Our online Annual tax calculator will automatically.

Past rules mentioned earlier in this article issued by the Internal Revenue Service required the Defense Accounting And Finance Service DFAS to withhold 25 of that bonus later reduced to 22 on payment. The current Social Security tax rate is 62 percent for employees. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

This marginal tax rate means that your immediate additional income will be taxed at this rate. One important difference with spending accounts and retirement accounts is that only 500 rolls over from year to year in an FSA.

Definition Of Debt The Word Debt In A Dictionary Word In Blue With Rest Of Pag Ad Word Dictionary Definition D Debt Simple Business Cards Bad Debt

2022 Federal State Payroll Tax Rates For Employers

Free New Hampshire Payroll Calculator 2022 Nh Tax Rates Onpay

Studio Apartments For Rent In Hooksett Nh Zillow

Flat Bonus Pay Calculator Flat Tax Rates Onpay

How Is Tax Liability Calculated Common Tax Questions Answered

Electop 12 Way Blade Fuse Block 12 Circuits With Negative Bus Fuse Box Holder With Led Indicator Damp Proof Protection Cover Sticker For Automotive Car Truck Boat Marine Rv Van Fuse Boxes Amazon

Grow Your Tax Awareness J P Morgan Asset Management

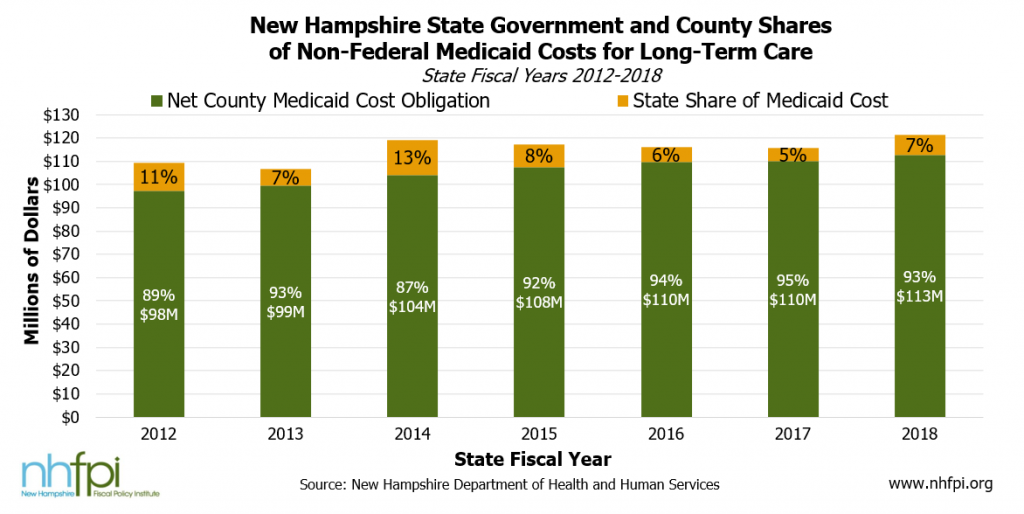

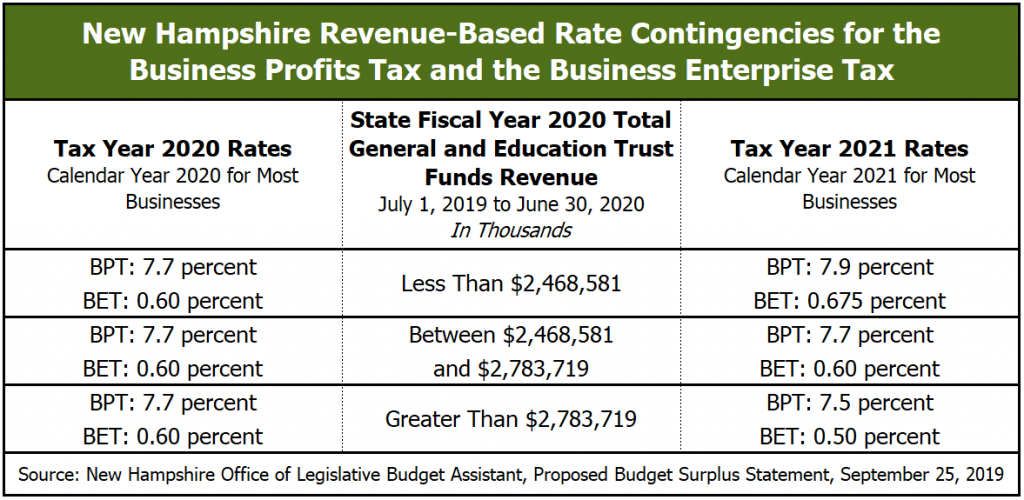

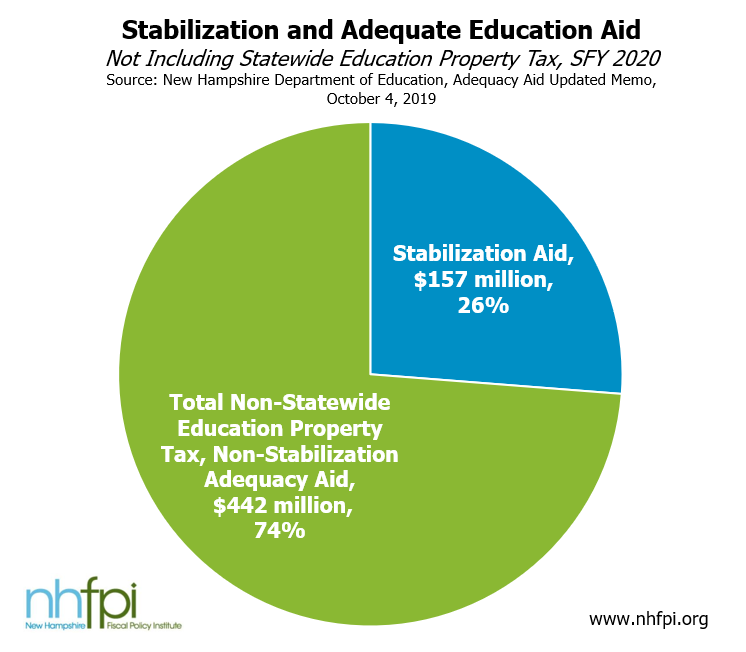

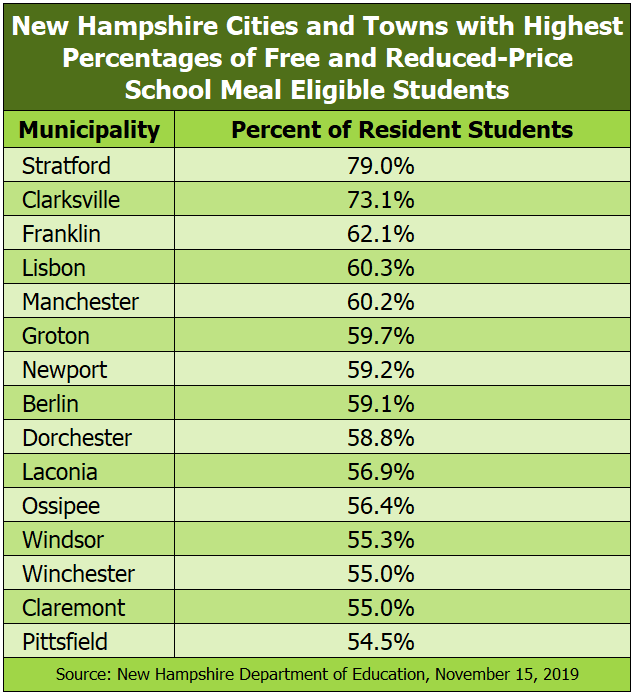

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

2022 Best Places To Buy A House In New Hampshire Niche

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

How Is Tax Liability Calculated Common Tax Questions Answered